Key takeaways:

- Geico is without doubt one of the lowest-cost automobile insurance coverage suppliers in most states, and sometimes THE lowest.

- Geico provides rideshare and private auto insurance coverage that may be bought on a single coverage, defending its clients throughout each work and pleasure.

- Geico provides industry-leading on-line instruments which permit clients to handle their insurance coverage insurance policies on their very own, with out having to take care of an agent.

- The corporate supplies an extended listing of reductions to assist get the bottom charges for insurance policies, in addition to a cellular app that lets you store for insurance coverage, pay premiums, entry your insurance coverage ID playing cards and file claims proper out of your telephone.

- Geico Categorical requires no login and permits quick access for patrons to make fast funds and entry and coverage info.

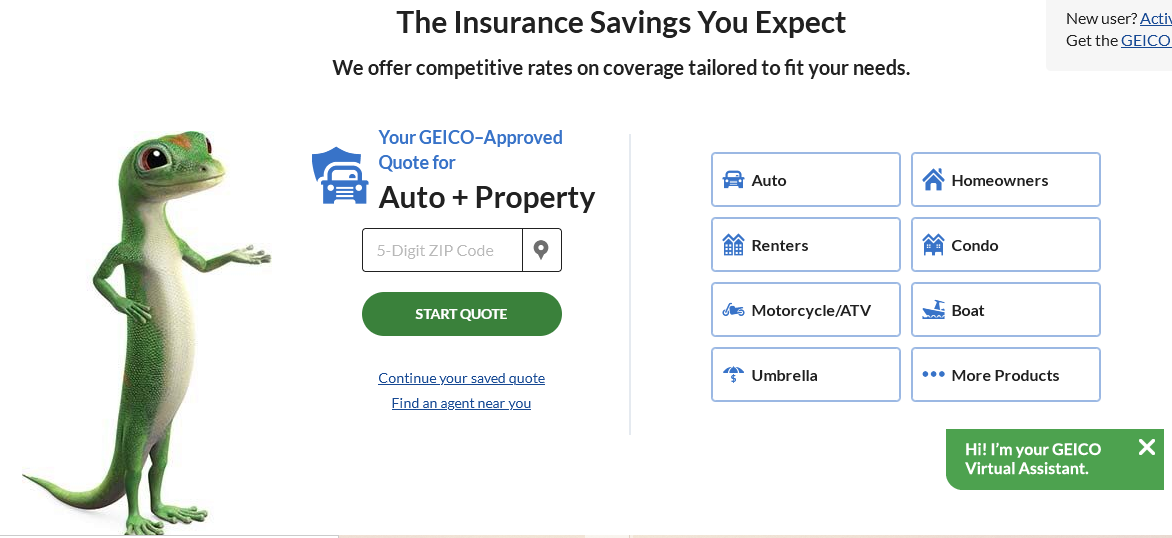

Due to that witty English gecko in all their commercials, Geico has develop into one of many best-known — and hottest — automobile insurance coverage corporations, the second-largest in America. Nevertheless, Geico provides many extra causes to decide on their insurance coverage over some other.

#ap48955-ww{font-family:Archivo,sans-serif}

#ap48955-ww{padding-top:20px;place:relative;text-align:heart;font-size:12px}#ap48955-ww #ap48955-ww-indicator{text-align:proper;colour:#4a4a4a}#ap48955-ww #ap48955-ww-indicator-wrapper{show:inline-flex;align-items:heart;justify-content:flex-end;margin-bottom:8px}#ap48955-ww #ap48955-ww-indicator-wrapper:hover #ap48955-ww-text{show:block}#ap48955-ww #ap48955-ww-indicator-wrapper:hover #ap48955-ww-label{show:none}#ap48955-ww #ap48955-ww-text{margin:auto 3px auto auto}#ap48955-ww #ap48955-ww-label{margin-left:4px;margin-right:3px}#ap48955-ww #ap48955-ww-icon{margin:auto;show:inline-block;width:16px;top:16px;min-width:16px;min-height:16px;cursor:pointer}#ap48955-ww #ap48955-ww-icon img{vertical-align:center;width:16px;top:16px;min-width:16px;min-height:16px}#ap48955-ww #ap48955-ww-text-bottom{margin:5px}

#ap48955-ww #ap48955-ww-text{show:none}#ap48955-ww #ap48955-ww-icon img{text-indent:-9999px;colour:clear}

Concerning the Firm

Geico is the second-largest auto insurance coverage supplier, primarily based on direct premiums written, with 13.6% of all auto insurance coverage in power within the U.S., trailing solely State Farm. The corporate has greater than 17 million clients nationwide, 28 million insured autos, with over $34 billion in direct premiums written.

Together with being one of many lowest price suppliers, Geico additionally supplies 24-hour service, seven days per week, 12 months a yr. Though the corporate’s main product is auto insurance coverage, they’re additionally affiliated with seven different corporations and supply a wide variety of different sorts of insurance coverage and protection to fulfill the wants of their clients.

On this assessment, we’re going to give attention to Geico automobile insurance coverage.

Geico Automobile Insurance coverage

Geico is without doubt one of the least expensive suppliers in most states, offering the bottom premiums in about 10 states.

Primary options of Geico automobile insurance coverage are as follows:

- Availability: All 50 states, plus the District of Columbia

- Coated autos: Autos, business autos, traditional vehicles, snowmobiles, bikes, leisure autos, ATVs/UTVs, and boats

- Buyer assist: 24/7 by telephone

- Claims satisfaction: Based on the JD Energy 2020 US Auto Claims Satisfaction Examine (launched in October, 2020), Geico ranks #12 out of 24 corporations offering automobile insurance coverage nationwide. They scored 871 out of a possible 1,000 factors, which is only one level beneath the {industry} common of 872.

- Monetary power ranking: A++ (Superior) from A.M. Greatest

- Higher Enterprise Bureau rating: A+ (on a scale of A+ to F)

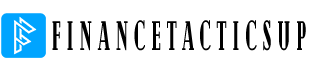

Find out how to Signal Up with Geico Automobile Insurance coverage

One of many options of the Geico utility course of we actually appreciated is the flexibility to get quotes on-line. By getting into primary info, we had been in a position to get quotes for varied driver profiles with no need to enter delicate info reminiscent of a Social Safety quantity or telephone quantity.

The net expertise that Geico supplies lets you get the data you want with out having to obtain any undesirable telephone calls or emails. It’s pressure-free quote discovering.

Distinctive Options

The bottom premium doesn’t all the time present the very best protection. There are a number of options that make Geico stand out from the competitors:

- Giant variety of reductions: Geico provides one of many widest ranges of reductions within the auto insurance coverage {industry}.

- Accident Forgiveness: Your insurance coverage charge received’t go up because of your first at-fault accident. Geico will waive the surcharge related to the primary at-fault accident: brought on by an eligible driver in your coverage. Geico Accident Forgiveness is per coverage, not per driver, nevertheless Geico will add extra accident forgiveness for loyalty.

- DriveEasy: Scores you primarily based in your driving abilities. Monitoring and evaluations undergo the cellular app.

- Rideshare protection: In case you drive for Uber, Lyft, or perhaps a meals supply service.

Geico Auto Insurance coverage Protection Choices

Geico provides normal auto insurance coverage protection provisions.

- Bodily harm and property legal responsibility protection.

- Collision and complete protection.

- Uninsured and underinsured legal responsibility protection.

- Medical fee and private harm safety protection.

Essential exclusion: Geico doesn’t provide Hole Insurance coverage, and so they suggest you get hold of that protection out of your leasing or financing firm if it’s wanted.

Optionally available protection provisions embody the next:

- Rental automobile reimbursement: Obtain reimbursement for a rental automobile whereas your automobile is within the store being repaired.

- Rideshare protection: Offers protection if you’re logged into your ridesharing app and ready for a visit request or buyer. However please bear in mind that this feature will not be out there in all states, and it’s included underneath a Geico business coverage.

- 24/7 roadside help: Contains leap begins, towing (non-accident), lockout service, gas supply and labor to vary a flat tire.

- Mechanical breakdown protection: This covers repairs to all mechanical elements of a brand new automobile, lower than 15 months previous and with lower than 15,000 miles.

- DriveEasy: Just like Progressive’s Snapshot, that is Geico’s manner of supplying you with a driving rating primarily based in your driving habits. As soon as the cellular app is downloaded in your smartphone, it detects and tracks your actions and evaluates your driving abilities.

Geico Reductions

Geico provides one of the crucial intensive lists of reductions within the auto insurance coverage {industry}.

Under is a listing of the reductions they provide, and the typical premium financial savings you possibly can count on:

- Air Bag: 23%

- Anti-Lock Brakes: 5%

- Anti-Theft System: 23%

- Daytime Operating Lights: 3%

- New Automobile Low cost: 15%

- Good Driver: 22% (5 Years Accident-Free)

- Seat Belt Use: Varies

- Defensive Driving: Varies

- Driver’s Training Course: Varies

- Good Pupil: 15%

- Emergency Deployment: 25%

- Federal Worker (Eagle): 12%

- Membership & Worker: Varies

- Army: 15%

- Multi-Automobile: 25%

- Multi-Coverage: Varies

Pattern Premiums

To offer affordable estimates of Geico automobile insurance coverage premiums, the desk beneath presents semi-annual premiums for 4 drivers underneath six eventualities every. We’ve obtained these by direct quotes from the Geico web site.

Three quotes are primarily based on legal responsibility quantities. Legal responsibility limits are expressed in a three-number sequence that appears like XX/XX/XX. The primary quantity within the sequence is the quantity of protection for an harm to 1 particular person in an accident that’s decided to be your fault. The second quantity is the protection restrict for all injured events in a single accident, whereas the third is protection for property harm to different folks’s property.

The bounds we’ve utilized in our desk are as follows:

1. 30/60/25 (the minimal protection allowed in Texas)

2. 50/100/50

3. 100/300/100

As well as, the desk additionally presents every legal responsibility protection quantity with uninsured and underinsured motorists, in addition to collision and complete protection added to the fundamental legal responsibility coverage.

We obtained quotes for 4 particular person driver profiles, together with a 23-year-old male, a 23-year-old feminine, a 53-year-old male, and a 53-year-old feminine. All 4 reside in suburban Houston, Texas (Zip Code 77001), and drive a 2018 Toyota Camry 12,000 miles per yr. Not one of the drivers has a transferring violation or at-fault accident declare within the earlier three years.

For simplicity’s sake, every driver is single, rents their house, and has a university diploma.

Listed here are the outcomes:

| Protection / Driver Profile | Male, 23 | Feminine, 23 | Male, 53 | Feminine, 53 |

| Price for State Minimal –30/60/25 – Legal responsibility Solely | $399 | $456 | $278 | $292 |

| With Un/Beneath-insured Motorist and Collision & Complete | $1,051 | $1,113 | $714 | $748 |

| 50/100/50 – Legal responsibility Solely | $435 | $498 | $302 | $317 |

| With Un/Beneath-insured Motorist and Collision & Complete | $1,114 | $1,215 | $770 | $816 |

| 100/300/100 – Legal responsibility Solely | $499 | $561 | $345 | $363 |

| With Un/Beneath-insured Motorist and Collision & Complete | $1,112 | $1275 | $854 | $915 |

Who Geico Is Greatest For

Every state of affairs is completely different; subsequently we will’t provide the “proper” reply. However Geico often is the proper selection for you if any of the next apply:

- Geico is the lowest-cost supplier in your state on your driver profile (which it usually is).

- You take part in ridesharing actions.

- You’ve got a number of drivers and autos that can qualify for a number of quantity reductions.

- You want the concept of the all-online quote system and utility course of.

- You’re over 75, the place Geico provides among the lowest premiums within the {industry}.

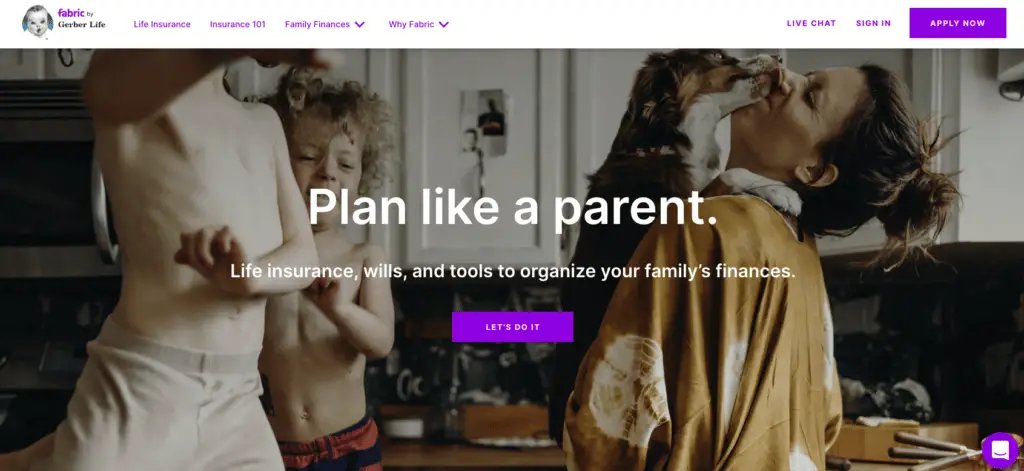

Geico vs. Different Automobile Insurance coverage Corporations

The desk beneath compares Geico with three of the most well-liked auto insurance coverage suppliers within the nation: Progressive, State Farm, and Allstate. We’ve used side-by-side comparisons of three standard protection ranges, in addition to the claims satisfaction and monetary power ranking for every firm.

| Class / Firm | Geico | Progressive | State Farm | Allstate |

| Common Annual Premium: State Minimal | $464 | $516 | $500 | $756 |

| Common Annual Premium: 50/100/50 with Collision & Complete | $1,006 | $1,106 | $1,190 | $1,754 |

| Common Annual Premium: 100/300/100 with Collision & Complete | $1,222 | $1,346 | $1,380 | $2,140 |

| J.D. Energy Claims Satisfaction Ranking | 871/1,000 | 856/1,000 | 881/1,000 | 876/1,000 |

| A.M. Greatest Monetary Energy Ranking | A++ (Superior) | A+ (Superior) | A++ (Superior) | A+ (Superior) |

The corporate that you simply really feel will work greatest for you’ll rely by yourself driver profile, your state of residence, and the particular wants and preferences you’ve got on your coverage.

What To Know About Auto Insurance coverage

Decrease premiums don’t all the time provide the most protection. When looking for automobile insurance coverage, you’ll need to ensure you carry sufficient protection within the occasion of an accident to stop any out-of-pocket bills. Under are some recommendations on what to search for when purchasing round for a premium.

- Ample protection — The legal responsibility limits in your coverage ought to approximate your internet price. State minimal protection is probably not sufficient in case your internet price is a number of hundred thousand {dollars}. Additionally, larger legal responsibility protection will be added at a surprisingly low premium enhance.

- Preserve clear credit score — The upper your rating, the decrease your premium will seemingly be.

- Further protection — Optionally available provisions like GAP, uninsured/underinsured motorist, rental reimbursement and emergency restore are cheap in comparison with the profit they supply.

- Deductible — A better deductible can decrease your premium, however it could actually put you in a monetary bind for those who received’t have the money out there to cowl it.

- Reductions — Ask every firm about all reductions they’ve — not all are revealed, and there could also be extra that can apply to you.

- Store round — Get quotes from a number of corporations and get the perfect charges and protection.

#ap7880-ww{font-family:Archivo,sans-serif}

#ap7880-ww{padding-top:20px;place:relative;text-align:heart;font-size:12px}#ap7880-ww #ap7880-ww-indicator{text-align:proper;colour:#4a4a4a}#ap7880-ww #ap7880-ww-indicator-wrapper{show:inline-flex;align-items:heart;justify-content:flex-end;margin-bottom:8px}#ap7880-ww #ap7880-ww-indicator-wrapper:hover #ap7880-ww-text{show:block}#ap7880-ww #ap7880-ww-indicator-wrapper:hover #ap7880-ww-label{show:none}#ap7880-ww #ap7880-ww-text{margin:auto 3px auto auto}#ap7880-ww #ap7880-ww-label{margin-left:4px;margin-right:3px}#ap7880-ww #ap7880-ww-icon{margin:auto;show:inline-block;width:16px;top:16px;min-width:16px;min-height:16px;cursor:pointer}#ap7880-ww #ap7880-ww-icon img{vertical-align:center;width:16px;top:16px;min-width:16px;min-height:16px}#ap7880-ww #ap7880-ww-text-bottom{margin:5px}

#ap7880-ww #ap7880-ww-text{show:none}#ap7880-ww #ap7880-ww-icon img{text-indent:-9999px;colour:clear}

Different Companies Provided by Geico

- House Insurance coverage

- Bike, ATV, RV, and Boat insurance coverage

- Private umbrella Insurance coverage

- Life insurance coverage

- Flood insurance coverage

- Abroad insurance coverage

- Enterprise Insurance coverage

- Skilled Legal responsibility insurance coverage

- Common Legal responsibility insurance coverage

- Industrial Auto insurance coverage

- Collector Automobile insurance coverage

- Id Safety

- Jewellery insurance coverage

- Medical Mal-Observe Insurance coverage

- Pet Insurance coverage